Following the widespread effects of the Covid-19 outbreak, Congress enacted aid programs to help businesses recover financially. The Employee Retention Credit was one such initiative (ERC). The ERC provides payroll tax credits to qualifying businesses for wages and health insurance contributions to their staff.

Who Qualifies for ERC

Applying for the ERC at a specific period may increase or decrease your chances of being approved. If you want ERC explained to you, to qualify, you must have been the head of a business or tax-exempt organization temporarily or permanently closed due to Covid-19. You must also demonstrate that your sales dropped by more than 50% from the prior year’s levels, as measured by comparable gross receipts. To be eligible for the following year, you must demonstrate an 80% drop in gross receipts compared to the previous year. Gross sales for 2020 can be used as a benchmark if, for example, your company didn’t exist in 2019.

How to Claim the Tax Refund

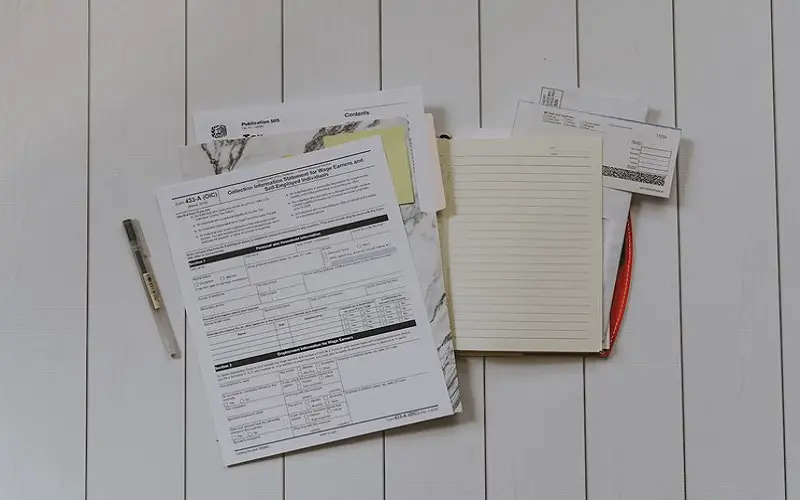

Companies can still apply for the ERC even when the program has ended. This tax credit is claimed on IRS Form 941, submitted alongside your federal tax return. Numerous companies, notably those who borrowed from the Paycheck Protection Program in 2020, were under the false impression that they were ineligible for the ERC. You can apply for the ERC retrospectively by submitting a Federal Tax Return for Adjusted Employers for the quarter in which you realized you were eligible.

Benefits

Maximum Reimbursement Per Employee Is $26,000

Businesses of all sizes that kept workers during the Covid-19 outbreak will be eligible for financial assistance through the ERC, a federal grant program. In contrast to loans, ERC payments are refundable tax credits funded by the Internal Revenue Service. Payroll costs and medical insurance contributions will influence the maximum amount you can receive for each worker.

Profits through Referral to an ERC

You have the unique opportunity to expand your business while assisting others in doing the same, thanks to your years of experience with referral models. Those who successfully bring clients on board are rewarded with a share of the contract, which is a win-win situation for everyone involved. The fact that you could use this government funding similarly is fascinating. If you run a business and are searching for additional ways to increase your income, consider teaming up with a firm that specializes in preparing and submitting applications for government grants to the Internal Revenue Service.

Several companies will pay a referral fee if the referred business meets the requirements and obtains ERC funding. This allows you to benefit from the program even if you don’t have a business.

Myths

Compliance with any Law or Regulation will Get you ERC

Not every government directive or regulation meets the criteria. Some assure firms that they can meet the requirements if they follow the CDC and OSHA standards. Yet that’s not always the case. A company must jump through numerous hoops to prove that a government order satisfies the government order criteria and hence is eligible for ERC. An order must first be an order, not merely a recommendation or a suggestion. A government order specifying that a corporation MUST do something starkly contrasts a recommendation or recommendation-based guideline. Be wary of relying on the latter, as neither you nor your ERC counselor can use them to meet the requirements.

In addition, the IRS advice makes it quite apparent that orders relying on COVID-19 must restrict commerce, travel, or group meetings for religious, social, commercial, or other objectives. In the end, government orders must have authority over the employer’s operations and have an appreciable effect on the firm.

You are Eligible for ERC if COVID has Impacted you

Most business owners and their CPAs know the two ways to qualify for the ERC: a loss in revenue or an impact on the company. Nonetheless, many people have the incorrect impression that they are entitled to compensation for any difficulties COVID may have caused in the normal functioning of their firm. Reject the notion outright. Modifying business as usual to account for COVID won’t get you an ERC. The business impact test requires applicants to demonstrate two things:

- that their firm was adversely affected by a government order or directive connected to COVID; and

- how severe and for how long that adverse effect persisted. In a nutshell, you’ll need to demonstrate that the order affected your company that was “more than nominal” when it was in place. It’s best practice to keep records of the precise government order and its effects on your firm when it was in effect.

Many business owners may find it difficult to determine eligibility because the tax laws governing the ERC have changed. Determining which wages qualify and which do not is also challenging. If you run many enterprises, the process becomes considerably more difficult. Also, completing the IRS paperwork wrong can cause the entire procedure to be delayed. It may be beneficial to seek advice from a tax expert if you’re having trouble applying for the ERC.