Are you looking for a way to ensure reliable future profits? If so, you may be wondering how to invest your money. There are many different ways to do this, and it can be overwhelming to try and decide which option is right for you. In this blog post, we will discuss the basics of investing your money and provide some tips on how to get started. We will also recommend some of our favorite investment options for those who are just starting out!

Understand different investment types

First, it’s important to understand the different types of investments available. The two main categories are stocks and bonds. Stocks are a type of ownership in a company and can represent a great way to diversify your portfolio. Bonds, on the other hand, are loans that you make to an entity such as a government or corporation with the expectation that you will be paid back with interest.

For example, if you were to invest in a company’s stock, you would be buying a piece of ownership in that company. If the company does well and its stock value increases, so will your investment. However, if the company fails or loses money, then your shares may decrease in value – meaning you could lose some or all of your initial investment.

Determine your risk tolerance

When it comes to investing, it’s important to understand your own risk tolerance. Are you comfortable with taking on higher levels of risk in order to get potentially higher returns, or are you more interested in low-risk investments that offer steady growth? Knowing your own risk tolerance is key to finding the right investments for you.

A good idea is to start with low-risk investments such as CDs, bonds, and money market accounts. These generally offer steady growth over time and are fairly safe bets for the long term. Of course, you can also choose to invest in stocks or other higher-risk options if you feel comfortable doing so – just be aware of the potential for loss if your investments do not perform as expected.

Research potential investments

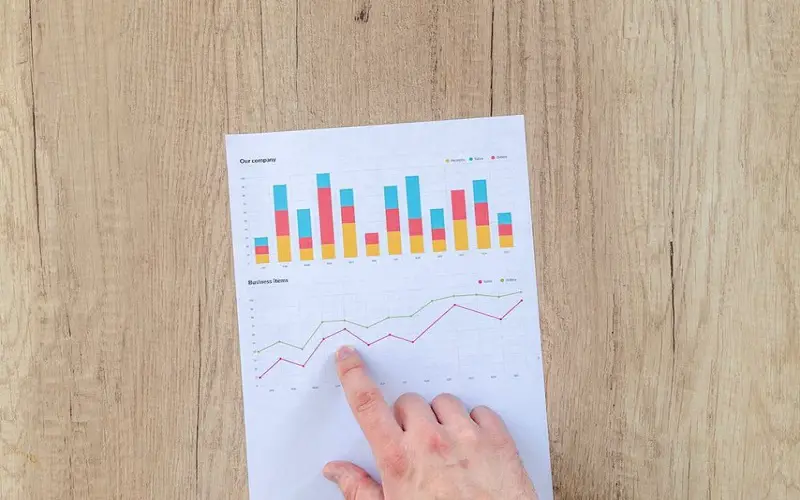

Once you know your risk tolerance and have an idea of the type of investments you are interested in, it’s time to do some research. Before investing any money, take the time to carefully evaluate potential investments. This means looking into the company’s past performance and evaluating its financial statements. Namely, you can look for Noble Gold reviews, to make sure the IRA you choose is reliable and trustworthy. Other important aspects to look for include a company’s management team, its current financial position, and any legal or regulatory issues it may be facing.

Pay attention to those companies that have a history of consistent growth and profitability, as these are likely to be the best investments. It’s also important to consider the company’s management team and any potential risks associated with the investment.

Choose an investment strategy

Once you have decided on your risk tolerance, it’s time to choose an investment strategy. You may decide to invest in a few different types of stocks and bonds, or you may prefer a diversified portfolio that includes multiple asset classes such as real estate and commodities. It’s important to choose a strategy that fits your goals and risk tolerance. One of the best tips for beginning investors is to start with small, low-risk investments and gradually increase the risk level as you gain more experience. This allows you to get comfortable with the investing process without risking too much of your capital.

Look for reliable investments

When you’re ready to start investing, it is important to look for reliable investments that can provide solid returns. This may mean taking the time to do research into stocks or bonds that have a proven track record of success, or it may mean investing in a mutual fund or index fund that is managed by professionals.

Start investing

Once you’ve determined your investment strategy and found reliable investments, it’s time to start investing. You can do this through a bank, broker, or online platform. Before investing, make sure to read the paperwork carefully and understand the terms and conditions. The amount you invest should also be determined by your own risk tolerance and goals. Sometimes it’s best to start small and then increase your investments over time.

Investing your money can seem overwhelming at first, but it is possible to find reliable investments that can provide you with substantial returns over time. Use the tips above to get started and make sure to do your due diligence when researching different investment options. With some careful planning and research, you can ensure a successful investment portfolio and reliable future profits.